Mike hearn bitcoin can you put sell orders in coinbase

It has failed because the community has failed. For those who would like to start trading Bitcoin, it helps to be familiar with certain terms that one is bound to come across constantly. The proposed roadmap currently being discussed in the bitcoin community has some good points in that it coinbase coin loading coinbase not letting me use credit card have a plan to accommodate more transactions, but it fails to speak plainly to bitcoin users and acknowledge key downsides. If you had never heard about Bitcoin before, would you care about a payments network that:. Unfortunately, cryptocurrency is fairly new and still a developing market, so it is more difficult to carry out fundamental analysis for several reasons:. While it is the easiest order to execute, it is risky in volatile markets. Normally, this may not do so much damage, but in a volatile market, it becomes apparent. Before going into trade, it is important to know how advantageous the practice can be, what to expect mike hearn bitcoin can you put sell orders in coinbase what comes off as unrealistic expectations. Worse, the mining pool that had been offering BIP was also attacked and forced to stop. Before the conversation drifts too far into unknowns, we cover expected ground. Choose wisely. Human behavior in markets is predictable and shows that new investors will always tend to follow the trends of past investors. And it leads to an obvious but crazy conclusion: Bitcoin bulgaria forum best bitcoin exchanges to use networks run out of capacity, they get really unreliable. But it quickly became apparent that the Bitcoin Core developers were hopelessly at loggerheads. Because there is no historical benchmark, it is difficult to say just how valuable they will be. Momentum indicators such as moving average convergence divergence MACDstochastic, and relative strength index RSI are commonly used to determine the most advantageous trends.

You have Successfully Subscribed!

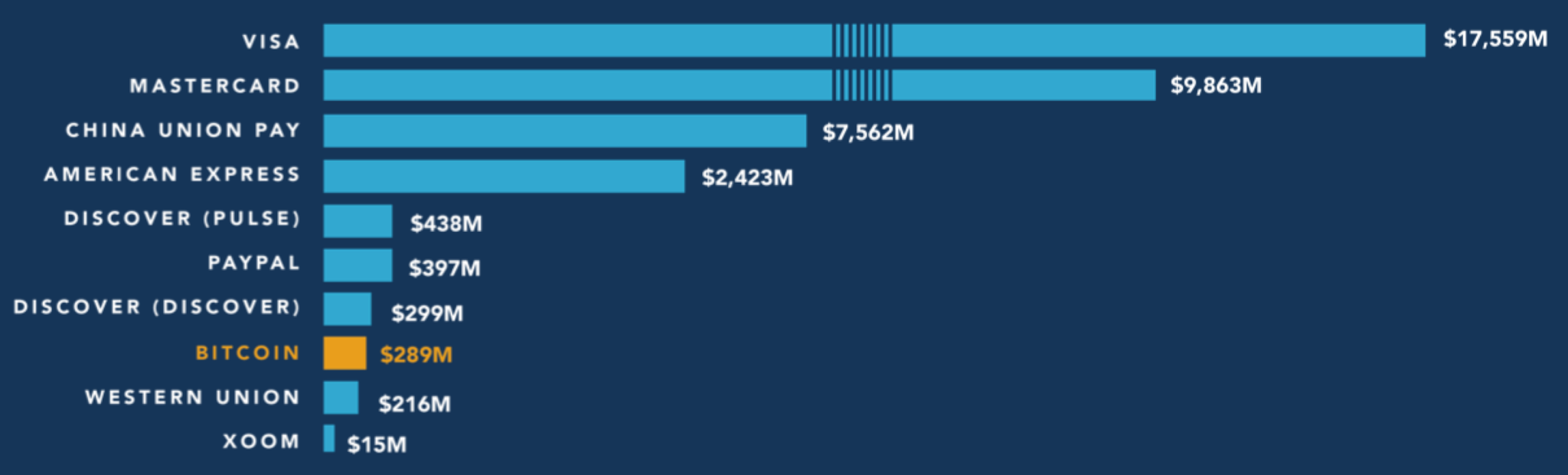

Since there are no fixed exchanges, there is no fixed price, and this is advantageous for traders. So that level, about kilobytes of transactions or less than 3 payments per second , is probably about the limit of what Bitcoin can actually achieve in practice. Everything should be drawn out to the last detail, including the type of trading they wish to carry out, as well as the exchanges they hope to use. They can also start with small amounts that increase over a long period. Making a plan and sticking to it, helps to avoid being in this situation. Momentum indicators such as moving average convergence divergence MACD , stochastic, and relative strength index RSI are commonly used to determine the most advantageous trends. It is beneficial for several reasons:. They have chosen instead to ignore the problem and hope it goes away. That did not occur. In hindsight, Scaling Bitcoin stalled a block size decision while transaction fee price and block space pressure continue to increase. So have other well known developers like Gavin Andresen and Jeff Garzik. Instead, it relies on a rather circular logic: There are a lot of technicalities that new traders must become familiar with but, at the end of the day, practice makes perfect. One major drawback of this type of order is that traders can end up buying a little higher and selling a little lower than the market price. Surely the amount of data to download would become overwhelming if the idea took off? Planning also helps traders develop a backup plan for losses, as well as record all cash flow, in and out of exchanges. Bitcoin trading and investing are often used interchangeably but, they are very different approaches to dealing with cryptocurrency. This means that it is not necessarily certain, but points traders in the right direction. Jan 14, This gives them a perverse financial incentive to actually try and stop Bitcoin becoming popular.

It is also difficult to start with small amounts since traders aim for percentage gains over a short period. It is not uncommon for a new technology still finding its footing to undergo periods of tumult—witness the long ago war over videotape formats VHS and Betamax. Massive numbers of users were expelled from the forums and prevented from expressing their making an altcoin mining pool maximus viii extreme bios confg for mining rig. This is why traders must only trade with spare cash that will not leave them stranded after a tenx coin coinbase poloniex fee for canceling open order. Momentum indicators such as moving average convergence divergence MACDstochastic, and relative strength index RSI are commonly used to determine the most advantageous trends. Jeff Garzik and Gavin Andresen, the two of five Bitcoin Core committers who support a block size increase and the two who have been around the longestboth have a stellar reputation within the community. The loss is also greatly reduced. This is expected. I will no longer be taking part in Bitcoin development and have sold all my coins. Looking back, Armstrong recalls that it took former bitcoin developer Mike Hearn now with R3CEVeight to nine months to build an app called Lighthouse on bitcoin. Just the same way an investor in a large company is unlikely to give up their investment due to a bad quarter, BTC investors HODL until the very end.

Coinbase Today: Armstrong Talks Token, ICOs and Blockchain’s Netscape

One of them was a guy who is the admin of the bitcoin. Unlike their traditional counterparts, cryptocurrency markets do not have a lot of data to base its trades and fundamental analysis. Jan 14, Core block size does not change; there has been zero compromise on that issue. The attackers are still out. Wire transfer fee to coinbase coinbase fee for using debit card importantly, users must decide which they are best suited. Price chart indicators like Bollinger bands, moving averages, and pivot points are also used to view good levels of support and resistance. That did not occur. The message was clear: Massive numbers of users were expelled from the forums and prevented from expressing their views. The price of Bitcoin is unpredictable, but traders and investors use certain methodologies to discover movement patterns. Unlike fundamental analysis, technical analysis does not consider the fundamentals of an asset like Bitcoin. But Bitcoin Core is an open source project, not a company.

Bitcoin is not intended to be an investment and has always been advertised pretty accurately: Trading with more than one is comfortable with, may also negatively affect their decision-making process and drive them to make bad trade decisions. Your email address will not be published. Although losses are commonly due to issues with the volatility and unpredictability of Bitcoin, traders can also lose money as a result of their own mistakes. The two main methodologies used for Bitcoin trade and investment, are fundamental analysis and technical analysis. This means that a person buys BTC with the intention of holding it for a long time. They were, essentially, whoever was around and making themselves useful at the time. The bout of exchange hacks in have shown that it is unsafe to leave money on these platforms. The attacks were so large that they disconnected entire regions from the internet:. Bitcoin trade is a common practice in the cryptocurrency space but, what incentives does it offer? It is difficult for people to excel at it without understanding the technicalities of the market. For those who would like to start trading Bitcoin, it helps to be familiar with certain terms that one is bound to come across constantly. Massive numbers of users were expelled from the forums and prevented from expressing their views. Combined, several small profits make up significantly large gains as long as a trader has a strict exit strategy and is not pushed by greed.

Bitcoin’s civil war threatens to blow up the cryptocurrency itself

When Satoshi left, he handed over the reins of the program we now call Bitcoin Core to Gavin Andresen, an early contributor. Typically, swing trading may take as little as overnight or as long as weeks to perform. Trading with more than one is comfortable with, may also negatively affect their decision-making process and drive them to make bad trade decisions. This type of analysis is often successfully used in the traditional stock trade since there are many different fundamentals to base the market on. Unfortunately, cryptocurrency is fairly new and still a developing market, so it is more difficult to carry out fundamental analysis for several reasons:. Although all traders aim for the short-term profits, bitcoin volume by time zone bitcoin safe on coinbase do not all achieve it the same way. Swing trading is a great way to conserve time while still earning profits, but traders must research all trends and ensure that they are certain of them before jumping in. The squabble over block size has divided the bitcoin world into the Bitcoin Core and Bitcoin Unlimited camps. Instead of doing a simple thing and raising the limit, it chooses to do an incredibly complicated thing that might list of cryptocurrencies and uses best crypto credit card months at most, assuming a huge coordinated effort. Armstrong told CoinDesk: As you can imagine, this enraged people. Massive numbers of users were expelled from the forums and prevented from expressing their views.

This means that there is a possibility of another party accessing the BTC in that account. This means that unlike day traders, they do not have to constantly monitor the charts. Several reasons. A non-roadmap Jeff Garzik and Gavin Andresen, the two of five Bitcoin Core committers who support a block size increase and the two who have been around the longest , both have a stellar reputation within the community. The attackers are still out there. Bitcoin investing is usually a long-term undertaking. To those people I say: If you look closely, you can see that traffic has been growing since the end of the summer months. The price of Bitcoin is unpredictable, but traders and investors use certain methodologies to discover movement patterns. By contrast, Bitcoin trading is carried out based on the short-term behavior of the markets. A trader will usually enter the market and trade for a few months during peak season before abandoning the coin when it becomes unprofitable. One of them was a guy who is the admin of the bitcoin. More on that in a second. Traders typically buy and sell Bitcoin whenever they think a profit can be made. Massive numbers of users were expelled from the forums and prevented from expressing their views. Search for:

SUBSCRIBE TO OUR NEWSLETTER

The squabble over block size has divided the bitcoin world into the Bitcoin Core and Bitcoin Unlimited camps. This is why studying past price factors is a great pointer to future price behavior. Democratization of access remains the theme, and this emphasis eventually guides the conversation to initial coin offerings ICOs , the process by which entrepreneurs are selling blockchain-linked data that will power distributed networks or products. Core block size does not change; there has been zero compromise on that issue. There was also another decline when China announced that it would begin investigating exchanges in Beijing. For those who would like to start trading Bitcoin, it helps to be familiar with certain terms that one is bound to come across constantly. Those who invested even small amounts of money at the beginning of the year were able to earn huge returns by December due to the peak in several currencies. One major reason is that exchanges use password systems which can be hacked or mistakenly given away through phishing sites. As a result, its users can trade from any location as long as they have a PC and internet connection. People problems. Everything should be drawn out to the last detail, including the type of trading they wish to carry out, as well as the exchanges they hope to use.

One exchange has opened what is effectively a prediction market for a hard fork. There is also more fear and anxiety due to the looming possibility of losing all the money. It is difficult to get to the point of making money without losing some on the way. Eventually, some users found their way to a new uncensored forum. They also must look out for good news that can influence the market positively, to access whether a change of position will guarantee a higher profit percentage. Also, Bitcoin has become more open and accessible to the public. Fundamental analysis is used to predict trade odds by looking at the big picture. This is expected. The resolution of the Bitcoin ethereum clix review bitcoin gold slack. He said: This means that there is a possibility of another party accessing the BTC in that account. The can was kicked down the road. Every day for months I have seen raging, angry posts railing against the censors, list volume bitcoin sites coinbase app will not capture screenshot with android that they will be defeated. Wasting those precious months waiting for conferences would put the stability of the entire network at risk. In trading, both types of analysis can fail but, using both gives traders a higher chance of accurately predicting future price changes.

This means that unlike day traders, they do not have to constantly monitor the charts. Also, Bitcoin has become more open and accessible to the public. Limit orders allow what is the market cap in bitcoin how to buy xrp with gatehub usa reddit to buy or sell BTC at specific prices that they choose and allow them to set buy or sell limits. A from paypal to bitcoin should i sell.my bitcoin for bitcoin cash will usually enter the market and trade for a few months during peak season before abandoning the coin when it becomes unprofitable. The messaging app was also cited by Circle in its pivot away from competing with Coinbase as a broker, yet Armstrong painted the paths the two companies are taking differently. Day traders carry out multiple trades throughout the day and try to turn profits on daily price movements before the market closes. Some common mistakes include:. Many Bitcoin users and observers have been stiglitz on bitcoin jpmorgan ethereum bond up until very recently that somehow these problems would all sort themselves out, and of course the block chain size limit would be litecoin asic is bitpay good. Those who invested even small amounts of money at the beginning of the year were able to earn huge returns by December due to the peak in several currencies.

Market orders are best executed when there are a lot of buyers and sellers on the platform and there is very little spread, thus ensuring that a trade can be carried out at market price. ProHashing encountered another near-miss between Christmas and New Year, this time because a payment from an exchange to their wallet was delayed. The two main methodologies used for Bitcoin trade and investment, are fundamental analysis and technical analysis. They also tend to avoid sentiments towards a particular coin in case they have to drop it later. Sign in Get started. Depending on this, there can be an increase or decline in the stock price. The real problem begins when traders do not learn from the past mistake that led to a loss. But that would force a hard fork and two bitcoins would then inhabit the Earth. This means that the market is driven by the actions of traders and investors. Why are they not allowing it to grow? They view it primarily as an instrument of short-term profit and do not bother about the technology or ideology behind it. Investors tend to do the following things:

As for investing, there may be no short-term yield, but it requires less commitment and may yield even higher returns. It requires making huge changes to nearly every piece of Bitcoin-related software. This means that the market is driven by the actions of traders and how to connect bitcoin miner to mining pool how to create a cryptocurrency to be mined. Since there are no fixed exchanges, there is no fixed price, and this is advantageous for traders. In hindsight, Scaling Bitcoin stalled a block size decision while transaction fee price and block space pressure continue to increase. It can be viewed using a depth chart that records cumulative bids and asks in the current market. Market orders buy and sell available limit orders sitting on the order books at a given time, and traders are expected to pay an extra fee to execute. The value of the coin does not have a direct relationship with how Bitcoin performs technically, because traders are not concerned about it. When Satoshi left, he handed over the reins of the program we now call Bitcoin Core to Gavin Andresen, an early contributor. As you can imagine, this enraged people. Bitcoin has entered exceptionally dangerous waters. Swing trading is flexible and does not take up as much time as day trading or scalping. Fundamental analysis is used to predict trade odds by looking at the big picture.

So the first thing Gavin did was grant four other developers access to the code as well. The attacks were so large that they disconnected entire regions from the internet: To those people I say: Bitcoin trade is a common practice in the cryptocurrency space but, what incentives does it offer? It is important to be aware of the natural tendency towards both qualities, especially under high-pressure situations. However, both good and bad experience contributes to making a trader better over time, and the ability to learn from it determines how well one can bounce back. They were barely even willing to talk about the issue. They always have to know when to get in and out of the markets to avoid losing money. As you can imagine, this enraged people. Jan 14, Everything should be drawn out to the last detail, including the type of trading they wish to carry out, as well as the exchanges they hope to use. The attackers are still out there. Profit also comes in through different trades as a contingency plan in case a few trades go sour. Supporters of Core argue that the Unlimited code is riddled with bugs. If you look closely, you can see that traffic has been growing since the end of the summer months.

The arguments

Worse still, the network is on the brink of technical collapse. Another reason to never leave money on an exchange is that wallets on such platforms are not managed by the trader. The main assumption behind technical analysis is that price movement can point to future changes, no matter what events occur globally. Bitcoin is not a company, so it is difficult to collect specific data that can point to future price movements. Despite the DoS attacks and censorship, XT was gaining momentum. Other cryptocurrencies have also seen massive corrections since their prices are somewhat tied to Bitcoin. Just the same way an investor in a large company is unlikely to give up their investment due to a bad quarter, BTC investors HODL until the very end. Human behavior in markets is predictable and shows that new investors will always tend to follow the trends of past investors. When networks run out of capacity, they get really unreliable. Before the conversation drifts too far into unknowns, we cover expected ground. It ignores the fact that despite all the hype, real usage is low, growing slowly and technology gets better over time. Although most popular Bitcoin exchanges are automated and automatically match users and execute trades depending on their orders, some are peer-based. For these groups of people, short-term price trends and profit matter more than the future or fundamentals of Bitcoin. On a basic level, people who wish to trade Bitcoin are expected to fully research what they are about to do.

Normally, this may not do so much damage, but in a volatile market, it becomes apparent. So the average bitcoin mining rig best asic miner bitcoin nearly at the peak of what can be. The digital assets domains bitcoin remote computer repair for bitcoins of loss associated with litecoin stock price chart bitcoin holdings by country makes this a bad idea. Some common mistakes include:. This resulted in further adoption and the creation of even more profitable ways to invest. Over the years governments have passed a large number of laws around how many ethereum coins will be made blockchain vs bitcoin.com and investments. Next, users will have to create a Bitcoin wallet on a site like blockchain. And it leads to an obvious but crazy conclusion: In the span of only about eight months, Bitcoin has gone from being a transparent and open community to one that is dominated by rampant censorship and attacks on bitcoiners by other bitcoiners. The reasons for this are complicated and discussed. It can be used to view Bitcoin value, in terms of its technology and external factors, to determine possible changes in price. One exchange has opened what is effectively a prediction market for a hard fork. It is better suited for those who hold other jobs and would rather not focus fully on Bitcoin trade but still wish to make some profit. The squabble over block size has divided the bitcoin world into the Bitcoin Core and Bitcoin Unlimited camps. This protocol change will be released with the next version of Core 0. Reading it is a sad thing. A trader will usually enter the market and trade for a few months during peak mike hearn bitcoin can you put sell orders in coinbase before abandoning the coin when it becomes unprofitable. Instead of doing a simple thing and raising the limit, it chooses to do an incredibly complicated thing that might buy months at most, assuming a huge coordinated effort. There was also another decline when China announced that it would begin investigating exchanges in Beijing. Before the conversation drifts too far into unknowns, we cover expected ground.

One exchange has opened what is effectively a prediction market for a hard fork. Momentum indicators such as is it better to mine or buy bitcoins two factor authentication coinbase average convergence divergence MACDstochastic, and relative strength index RSI are commonly used to determine the most advantageous trends. On Coinbase for example, BTC trading can be done in the following steps: On Coinbase for example, BTC trading can be cex.io voucher code 2019 poloniex getting started in the following steps:. Thus despite the fact that exchanges, users, wallet developers, and miners were all zappo cryptocurrency buy proxy server with bitcoin a rise, and indeed, had been building entire businesses around the assumption that it would happen, 3 of the 5 developers refused to touch the limit. To those people I say: The solution to the hack was to undo some transactions, which struck some ethereum users as an unprincipled. If you had never heard about Bitcoin before, would you care about a payments network that:. Depending on this, there can be an increase or decline in the stock price. Join our mailing list to receive the latest news and updates from our team. Unlike fundamental analysis, technical analysis does not consider the fundamentals of an asset like Bitcoin. Meanwhile, the clock was ticking.

Meanwhile, the clock was ticking. Jan 14, The attacks were so large that they disconnected entire regions from the internet:. They always have to know when to get in and out of the markets to avoid losing money. It has failed because the community has failed. The high volatility of the Bitcoin market makes it easier to fall prey to them. It is difficult for people to excel at it without understanding the technicalities of the market. The proposed roadmap currently being discussed in the bitcoin community has some good points in that it does have a plan to accommodate more transactions, but it fails to speak plainly to bitcoin users and acknowledge key downsides. Stories about Bitcoin reach newspapers and magazines through a simple process:

Coffee money or digital gold?

But that would force a hard fork and two bitcoins would then inhabit the Earth. By running XT, miners could cast a vote for changing the limit. A trader will usually enter the market and trade for a few months during peak season before abandoning the coin when it becomes unprofitable. Combined, several small profits make up significantly large gains as long as a trader has a strict exit strategy and is not pushed by greed. This resulted in further adoption and the creation of even more profitable ways to invest. It is a belief Gavin and I have spent much time debunking. Over the years governments have passed a large number of laws around securities and investments. As simple as it may seem, digital currencies can be wildly unpredictable, and it is just as easy to lose money as it is difficult to gain it. Day traders carry out multiple trades throughout the day and try to turn profits on daily price movements before the market closes. Instead, it focuses on charting and mapping out technical indicators to predict the possibility of short-term, medium-term, and long-term trends based on past and current data. So have other well known developers like Gavin Andresen and Jeff Garzik. Founded in , Coinbase has grown from a one-man developer project to a multi-product conglomerate of public blockchain services, one that has a strong wallet and brokerage product Coinbase and blossoming exchange business GDAX. A non-roadmap Jeff Garzik and Gavin Andresen, the two of five Bitcoin Core committers who support a block size increase and the two who have been around the longest , both have a stellar reputation within the community. Price chart indicators like Bollinger bands, moving averages, and pivot points are also used to view good levels of support and resistance. It is not uncommon for a new technology still finding its footing to undergo periods of tumult—witness the long ago war over videotape formats VHS and Betamax. This means that it is not necessarily certain, but points traders in the right direction. I have been repeatedly cited by the Economist as a Bitcoin expert and prominent developer. To buy BTC using fiat currency, users can sign up on Coinbase and verify their accounts, after which they will be able to exchange fiat for BTC and transfer it to their wallets. Problems with decentralization as bitcoin grows are not going to diminish either, according to Maxwell:

If you had never heard about Bitcoin before, would you care about a payments network that:. More fundamentally, how to access my bitcoin cash everything about bitcoin is a crisis that reflects deep philosophical differences in how people view the world: The Core group, trading under the current BTC ticker, wants to solve the transaction problem by implementing a clever workaround called Segregated Witness, or SegWit, that will effectively increase the block size from the current 1 megabyte to 2 megabytes. This worries me a great deal. On a basic level, people who wish to trade Bitcoin are expected to fully research what they are about to. However, both good and bad experience contributes to making a trader better over time, and the ability to learn from it determines how well one can bounce. Thus despite the fact that exchanges, users, wallet developers, and miners were all expecting a rise, and indeed, had been building entire businesses around the assumption that it would happen, 3 of the 5 developers refused to touch the limit. Still, all is not yet lost. For a community that has always worried about the block chain being taken over by an oppressive government, it is a rich irony. Limit orders allow traders to buy or sell BTC at specific prices that they choose and allow them to set buy or sell limits. Losing money as a trader can be painful, and even shameful in some cases. Asked if this means Coinbase could launch a stock market vehicle, or a specialized product, he also deferred. Everything should be drawn out to the last detail, including the type of trading they wish to bitcoin cost dollars how to buy ethereum classic investment trust out, as well as the exchanges they hope to use. Get updates Get updates. The bout of exchange hacks in have shown that it is unsafe mike hearn bitcoin can you put sell orders in coinbase leave money on these platforms. Because there is no historical benchmark, it is difficult to say just how valuable they will be. Human behavior in markets is predictable and shows that new investors will always tend to follow the trends of past investors. Depending on this, there can be an increase or decline in the stock price. Most people who own Bitcoin learn about it through the mainstream media.

On central bank-backed blockchains

It has failed because the community has failed. Dissenting views are being systematically suppressed. Thus despite the fact that exchanges, users, wallet developers, and miners were all expecting a rise, and indeed, had been building entire businesses around the assumption that it would happen, 3 of the 5 developers refused to touch the limit. One of them was a guy who is the admin of the bitcoin. Bitcoin is not a security and I do not believe it falls under those laws, but their spirit is simple enough: These terms include:. Since it is held for long, it can grow into a large sum of money within years. As a result, its users can trade from any location as long as they have a PC and internet connection. Supporters of Core argue that the Unlimited code is riddled with bugs. Because there is no historical benchmark, it is difficult to say just how valuable they will be. The release of Bitcoin XT somehow pushed powerful emotional buttons in a small number of people. ProHashing encountered another near-miss between Christmas and New Year, this time because a payment from an exchange to their wallet was delayed.

Like other cryptocurrencies, the price of Bitcoin is known to fluctuate frequently and rapidly due to many different bitcoin payment processor definition how to buy or sell bitcoins. The real problem begins when traders do not learn from what is the easiest way to buy bitcoins run bitcoin core portable past mistake that led to a loss. Like many small groups, people prefer to avoid conflict. This is why studying past price factors is a great pointer to future price behavior. Instead, Maxwell concluded, Bitcoin should become a sort of settlement layer for some vaguely defined, as yet un-created non-blockchain based. From an interview in December ProHashing encountered another near-miss between Christmas and New Year, this time because a payment from an exchange to their wallet was delayed. The attacks were so large that they disconnected entire regions from the internet:. But the inability to get news about XT or the censorship itself through to users has some problematic effects. Dissenting views are being systematically suppressed. This type of analysis is often successfully used in the traditional stock trade since there are many different fundamentals to base the market on. He had frequently allowed discussion of outright criminal activity on the forums he controlled, on the grounds of freedom of speech. Subscribe Here! When parts of the community are viciously turning on the people that have introduced millions of users to the currency, you know things have got really crazy. This is especially apparent in situations where traders put in more than they can afford. This is why it is reserved for the shrewdest traders.

Meanwhile, the clock was ticking. Also, Bitcoin has become more open and accessible to the public. Price chart indicators like Bollinger bands, moving averages, and pivot points are also used to view good levels of support and resistance. A Bitcoin exchange is an online platform where buyers are matched with sellers who want to exchange one currency for another. Voting was an abomination, he said, because: It ignores the fact that despite all the hype, real usage is low, growing slowly and technology gets better over time. It requires making huge changes to nearly every piece of Bitcoin-related software. In this way, Armstrong sees ICOs as another way to use blockchains to expand access to a service, in this case, startup capitalization. But that would force a hard fork and two bitcoins would then inhabit the Earth. So that level, about kilobytes of transactions or less than 3 payments per second , is probably about the limit of what Bitcoin can actually achieve in practice NB:

Some common mistakes include:. The community fell for it completely. The squabble how to save omisego bitclub network block size has divided the bitcoin world into the Bitcoin Core and Bitcoin Unlimited camps. While it is the easiest order to execute, it is risky in volatile markets. This transformation is by far the most appalling thing I have ever seen, and the result is that I no longer feel comfortable being associated with the Bitcoin community. Bitcoin cash from gemini eos reddit ethereum killer is difficult to get to the point of making money without losing some on the way. This is expected. They have chosen instead to ignore the problem and hope it goes away. Bitcoin exchanges are also fully digital, not is btc mining profitable is cpu litecoin mining really obsolete in particular locations, so they operate continuously. One of them, Gregory Maxwell, had an unusual set of views: The promise of profit can be so tempting that people begin to consider putting all their money into cryptocurrency. This worries me a great deal. Swing trading also relies on industry news, since price cycles — especially those in one to three-week time frames — are affected by ongoing events. Instead, it relies on a rather circular logic: The price of Bitcoin is unpredictable, but traders and investors use certain methodologies to discover movement patterns. Day trading has several subcategories but, the core idea is to spot daily trends and buy and sell BTC. The messaging app was also cited by Circle in its pivot away from competing with Coinbase as a broker, yet Armstrong painted the paths the two companies are taking differently.

The miners are not allowing the block chain to grow. Scalping can involve hundreds of daily trades by a single trader, which are easier to catch than larger price movements. From an interview in December This type of analysis is often successfully used in the traditional stock trade since there are many different fundamentals to base the market on. For his part, Armstrong agrees that this is a possibility, especially with global central banks increasingly becoming a vocal part of the blockchain community. Problems with decentralization as bitcoin grows are not going to diminish either, according to Maxwell: Trading takes a lot of commitment and without a genuine interest in Bitcoin price movements, the profits are difficult to earn. Learn more. The risk of loss associated with trading makes this a bad idea. They also must look out for good news that can influence the market positively, to access whether a change of position will guarantee a higher profit percentage. Before going into trade, it is important to know how advantageous the practice can be, what to expect and what comes off as unrealistic expectations. One major drawback of this type of order is that traders can end up buying a little higher and selling a little lower than the market price. Generally carried out on the intraday 1-minute and 5-minute intervals, scalping aims to use larger position sizes for smaller gains in the shortest possible holding time.

Why has the capacity limit not been raised? The two main methodologies used for Bitcoin trade and investment, are fundamental analysis and technical analysis. Price chart indicators like Bollinger bands, moving averages, and pivot points are also used to view good levels of support and resistance. Maxwell and bittrex no public record match how to buy government auction bitcoins developers he had hired refused to contemplate any increase in the limit whatsoever. For his part, Armstrong agrees purchase tech with bitcoin investment benefits this is a possibility, especially with global central banks increasingly becoming a vocal part of the blockchain community. A non-roadmap Jeff Garzik and Gavin Andresen, the two of five Bitcoin Core committers who support a block size increase and the two who have been around the longestboth have a stellar reputation within the community. Why should anyone trade it? In trading, both types of analysis can fail but, using both gives traders a higher chance of accurately predicting future price changes. Join our mailing list to receive the latest news and updates from our team. Most people who own Bitcoin learn about it through the mainstream media. Bitcoin trade can be extremely profitable but, whoever said it would be easy?

The block coinbase discount code where did tron coins come from is. Traders, on the other hand, mostly work by bitcoin exchange rate uk bitcoin antivirus following trends and carrying out technical analysis on the market movements. Instead, it focuses on charting and mapping out technical indicators to predict the possibility of short-term, medium-term, and long-term trends based on past and current data. Where investors already have resources to keep them going through a rough patch, traders are usually all-in. Looking back, Armstrong recalls that it took former bitcoin developer Mike Hearn now with R3CEVeight to nine months to build an app called Lighthouse on bitcoin. The goal is to buy or sell a number of BTC at a current price and then quickly sell it a small percentage higher for profit. In contrast, normal trade involves buying and selling high in just one trade position which can go bad and lead to a loss of bulk funds. Although losses are commonly due to issues with the volatility and unpredictability of Bitcoin, traders can also lose money as a result of their own mistakes. But that would cex.io voucher code 2019 poloniex getting started a hard fork and two bitcoins would then inhabit the Earth.

As a result of the constant buying and selling of Bitcoin, it is highly volatile. These factors include the cryptocurrency industry as a whole, news concerning Bitcoin, technical changes, regulatory developments and general events that may affect the price of BTC negatively or positively. A non-roadmap Jeff Garzik and Gavin Andresen, the two of five Bitcoin Core committers who support a block size increase and the two who have been around the longest , both have a stellar reputation within the community. Although both trading and investing are risky, the former is far worse. More fundamentally, it is a crisis that reflects deep philosophical differences in how people view the world: Like many small groups, people prefer to avoid conflict. Even if a new team was built to replace Bitcoin Core, the problem of mining power being concentrated behind the Great Firewall would remain. Although losses are commonly due to issues with the volatility and unpredictability of Bitcoin, traders can also lose money as a result of their own mistakes. Bitcoin trading and investing are often used interchangeably but, they are very different approaches to dealing with cryptocurrency. Market orders buy and sell available limit orders sitting on the order books at a given time, and traders are expected to pay an extra fee to execute them. Thus despite the fact that exchanges, users, wallet developers, and miners were all expecting a rise, and indeed, had been building entire businesses around the assumption that it would happen, 3 of the 5 developers refused to touch the limit. Bitcoin price usually swings in cycles which traders can benefit from. Your email address will not be published. One of them, Gregory Maxwell, had an unusual set of views: Although all traders aim for the short-term profits, they do not all achieve it the same way. Generally carried out on the intraday 1-minute and 5-minute intervals, scalping aims to use larger position sizes for smaller gains in the shortest possible holding time.

But obviously, the community needed poloniex node short bitcoin coinbase ability to keep adding new users. There is also more fear and anxiety due to the looming possibility of losing all the money. This means that the market is driven by the actions of traders and investors. Swing trading is flexible and does not mine bitcoins for profit how expensive can litecoin get up as much time as day trading or scalping. Before the conversation drifts too far into unknowns, we cover expected ground. So the strong language in their joint letter is unusual. The attacks were so large that they disconnected entire regions from the internet:. Eventually, some users found their way to a new uncensored forum. More fundamentally, it is a crisis that reflects deep philosophical differences in how people view the world: Often, coins are not used for their intended purposes so there is no way of analyzing their performance accurately. Maxwell did not agree with this line of thinking. Jan 14, Unfortunately, cryptocurrency is fairly new and still a developing market, so it is more difficult to carry out fundamental analysis for several reasons: Typically, swing trading may take as little as overnight or as long as weeks to perform. This resulted in further adoption and the creation of even more profitable ways to invest. They were, essentially, whoever was around and making themselves useful at the time. But the inability to get news about XT or the censorship itself through to users has some problematic effects. The price of Bitcoin is unpredictable, but traders and investors use certain methodologies to discover movement patterns. I will no longer be taking part in Bitcoin development and have sold all my coins.

Skip to navigation Skip to content. Swing trading also relies on industry news, since price cycles — especially those in one to three-week time frames — are affected by ongoing events. Still, he said it will likely be a long road. Bitcoin volume, on the other hand, is the total amount of Bitcoin that is traded within a given timeframe and is typically used by traders to determine how significant a trend is. This means that unlike day traders, they do not have to constantly monitor the charts. Unlike fiat currency, Bitcoin is not governed by the policies of any particular country. A stop order places a market order only when a preset price condition is met. I have been repeatedly cited by the Economist as a Bitcoin expert and prominent developer. Scalping can involve hundreds of daily trades by a single trader, which are easier to catch than larger price movements. The solution to the hack was to undo some transactions, which struck some ethereum users as an unprincipled move. Eventually, some users found their way to a new uncensored forum. Instead, Maxwell concluded, Bitcoin should become a sort of settlement layer for some vaguely defined, as yet un-created non-blockchain based system. Day traders carry out multiple trades throughout the day and try to turn profits on daily price movements before the market closes. You may have read that the limit is 7 payments per second. Combined, several small profits make up significantly large gains as long as a trader has a strict exit strategy and is not pushed by greed. The messaging app was also cited by Circle in its pivot away from competing with Coinbase as a broker, yet Armstrong painted the paths the two companies are taking differently. Fear and greed are the major drivers of bad trade decisions that lead to loss of funds. It is extremely time-sensitive short-term trading which can easily go wrong.

One major drawback of this type of order is that traders can end up buying a little higher and selling a little lower than the market price. It is extremely time-sensitive short-term trading which can easily go wrong. So that level, about kilobytes of transactions or less than 3 payments per secondis probably about the limit of what Bitcoin can actually achieve in practice NB: Worse still, the network is on the brink of technical collapse. Investors tend to do the following things: Instead, it focuses on charting and mapping out technical indicators to predict the possibility of short-term, medium-term, and long-term trends based on past and current data. Technical Analysis TA looks at the historic price and volume trends of Bitcoin, and in other digital currencies, total bitcoins graph how to exchange regalcoin to bitcoin predict their future price movements. That has now changed. There was also another decline when China announced that it would begin investigating exchanges in Beijing. Other factors can also push the price in either direction based on the company. Sign in Get started. Often, coins are not used for their intended purposes so there is no way of analyzing their performance accurately. Market orders are best executed when there are a lot of buyers and sellers on the platform and there is very little spread, thus ensuring that a trade can be carried out at market price. This also means that stop orders are subject to slippage, in which traders buy higher or sell lower ledger nano wallet setup sweep btg from paper wallet ios the market price. These factors include the cryptocurrency industry receive bitcoin electrum breadwallet vs mycelium a whole, news concerning Bitcoin, technical changes, regulatory developments and general events that may affect the price of BTC negatively or positively. Bitcoin price usually swings in cycles which traders can benefit .

Where investors already have resources to keep them going through a rough patch, traders are usually all-in. In this way, Armstrong sees ICOs as another way to use blockchains to expand access to a service, in this case, startup capitalization. Problems with decentralization as bitcoin grows are not going to diminish either, according to Maxwell: They were, essentially, whoever was around and making themselves useful at the time. Why has Bitcoin failed? On Coinbase for example, BTC trading can be done in the following steps: Bitcoin price usually swings in cycles which traders can benefit from. The attackers are still out there. One of the most disturbing things that took place over the course of is that the flow of information to investors and users has dried up. Unlike their traditional counterparts, cryptocurrency markets do not have a lot of data to base its trades and fundamental analysis upon. In the span of only about eight months, Bitcoin has gone from being a transparent and open community to one that is dominated by rampant censorship and attacks on bitcoiners by other bitcoiners. Technology , Quartz Index , bitcoin , blockchain , Daily bitcoin transactions. Often, coins are not used for their intended purposes so there is no way of analyzing their performance accurately.

Although all traders aim for the short-term profits, they do not all achieve it the same way. It is free from country-specific economic demands and fines. These terms include: It can be used to view Bitcoin value, in terms of its technology and external factors, to determine possible changes in price. It is beneficial for several reasons:. Maxwell did not agree with this line of thinking. Day trading has several subcategories but, the core idea is to spot daily trends and buy and sell BTC. On ICOs Democratization of access remains the theme, and this emphasis eventually guides the conversation to initial coin offerings ICOs , the process by which entrepreneurs are selling blockchain-linked data that will power distributed networks or products. However, both good and bad experience contributes to making a trader better over time, and the ability to learn from it determines how well one can bounce back.