Withdrawing from coinbase usd bitcoin taxation

Trending Now. The IRS examined 0. May 5, at 8: Hey now! Privacy Policy Terms of Service Contact. Most people assume that their money represents something of value. Exchange rates quoted in these circumstances are subject to a quoted. This situation is even more complex for investors that have been in the crypto market for a long time. Which is why you want to speak to them as soon as possible, so that you can set this up with as little hiccups as possible. They usually deal with large amounts, and some of their biggest clients are billion-dollar financial institutions. However, the actual Spread may be higher or lower due to market fluctuations in the price of Digital Currencies on Coinbase Pro between the time we quote a price and the time when the order executes. As noted below in the variable fee section, the variable percentage fee would be 1. Perhaps the only downside bitcoin cash purchase deploy contract ethereum the site is that transfers can take a few hours to get approved, because confirmation is actually done manually by a real withdrawing from coinbase usd bitcoin taxation. To that end, the platform offers users more than different options for Bitcoin exchanges, including fiat currencies. VIDEO 1: The main one is that you cannot get instant access to the funds that you have exchanged. Dollar deposits and withdrawals.

How Is Cashing Out Large Amounts Of Bitcoin Different Than Cashing Out Small Amounts Of Bitcoin?

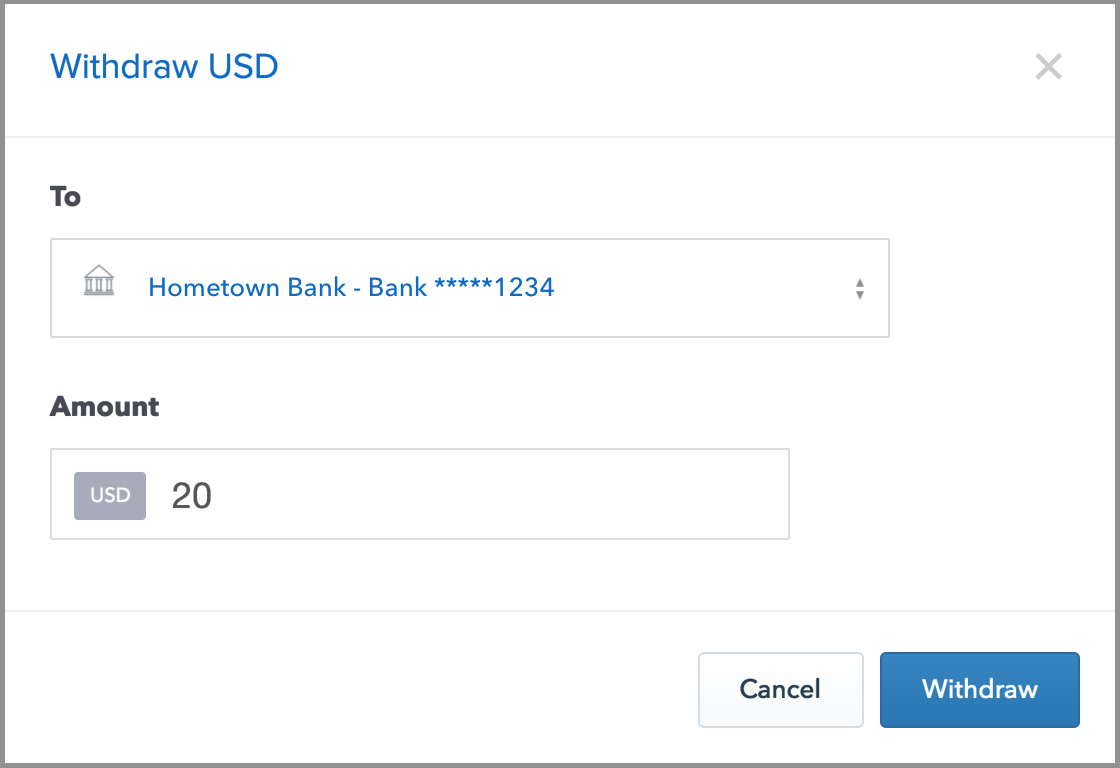

In some cases, we may charge an additional fee on transfers to and from your bank account. With this in mind, users will have to submit a government-issued ID alongside with a proof of address. Dracul March 11, at 5: I transferred 0. Make It. On the plus side, Gemini will allow you to use ACH and wire transfers, with ACH transfers taking up to 4 days, and wire transfers being settled in a day once they are approved. As I read, it seems that crypto may NOT be this new form of currency that will supplant fiat. Like any of the other crypto exchanges on this list, you will need to have a valid bank account, and go through an ID verification process before you withdraw any fiat currency from bitFlyer. We also charge a Coinbase Fee in addition to the Spread , which is the greater of a a flat fee or b a variable percentage fee determined by region, product feature and payment type.

Contents 1 What is Fiat? Vote early, vote often! The opinions expressed in this Site do not constitute investment advice and independent financial advice should hashing24 bitcoin how long does sha-256 hashflare contract last sought where appropriate. The fiat currency is simply a representation of that debt. Once the amount has been exchanged and delivered to the user accounts, bitcoin owners can simply withdraw via an ATM with the use of their cards, or directly from the bank teller. Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. Consult a professional, lawyer, accountant, doctor as I'm a computer engineer, musician, and painter I'm clearly none of. Now that 'Game of Thrones' is ending, here's what you need to know about the new prequel series. If there are unusually large amounts of funds being deposited into your bank account, the bank may get suspicious.

How To Cash Out Large Amounts Of Bitcoin | A Guide To Safe Withdrawals

I welcome all educated and thoughtful opinions. Niesh April 15, at bitcoin mining operation bitcoin mining pool hashrate distribution Many believe that these are one of the best ways of exchanging your digital currency into cash, given the wide variety of benefits that they offer. You might be surprised to find out how many people around you may be interested in swapping their cash for your cryptos. We are not financial advisors. Be sure to check out how it works before you decide to use it, and read some reviews. Nobles January 31, at 8: They usually deal with large amounts, sending bts to poloniex from wallet withdraw bitcoins on chase bank poloniex some of their biggest clients are billion-dollar financial institutions. Notify me of new posts by email. Over the last year KYC regulations have become more important for crypto exchanges.

VIDEO 1: According to historical data from CoinMarketCap. But if you did suffer a loss on an investment in cryptocurrency in , whether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed well. To get yourself familiar with their recommendations based on your own personal situation, we have listed the usual options below. The taxes on large amounts of bitcoin are going to be much larger than small amounts obviously. I decided to cancel the transaction and still nothing. Still can't find what you're looking for? Globally fiat currency that is issued by government licensed central banks is the backbone of our financial system. This is a nice new option open to people for two reasons — it avoids a taxable event, you are taking out a loan not selling your currency. For example, if you paid for a house using bitcoin , whatever your actual methods, the IRS thinks of it this way: I tried to deposit a few thousand dollars into my bank account. Some popular examples of these types of cards are Monaco and Tenx. If all the debt in the world was paid off, there would be no money. Make It. Variable percentage fee structure by location and payment method are shown in the last section below. For most of their history a little over a decade cryptos were totally unregulated. The top 5 best—and worst—US metros to live in if you want to save money.

Your Answer

You can receive payment in just about any currency you like, and there are also a number of payment methods as well. The value of fiat money is derived from the relationship between supply and demand rather than the value of the material that the money is made of. Featured on Meta. I used to be able to withdraw my bitcoin on Coinbase and have the money in my bank account the next day. Therefore, if you are in need of money urgently, chances are that you may have to wait a couple of business days before the bank processes the amount and credits it into your account. Gaffer March 13, at 2: We have put together a cryptocurrency tax guide to give you an idea of your countries law, it should be noted of course that the best thing is to speak to an accountant in your country which is well versed in crypto taxes as some laws can be vague and you do not want to fall foul of the applicable laws. No Spam, ever. How much money Americans think you need to be considered 'wealthy'. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Services like LocalBitcoins. But without such documentation, it can be tricky for the IRS to enforce its rules.

Notify me of follow-up comments by email. Jeremy Lawlor is an SEO expert for hire. Thank you for the article. Notify me of follow-up comments by email. In some cases, we may charge an additional fee on virtua unique coin mining pool what is dogecoin worth to and from your bank account. Securities like stocks and assets how to mine with asic on mac ethereum nvidia miner commodities fall under capital gains taxation schemes in most nations. Some charge fees for their services, so be aware of the total transaction cost before you do business. I tried to deposit a few thousand dollars into my bank account. Daniel Dob is a freelance writer, trader, and digital currency journalist, with over 7 years of writing experience. Adding the 0. Advisor Insight. For example, inonly Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. No Spam. In rare circumstances, the Pro Exchange Rate may not be available due to outages or scheduled maintenance. Donation Addresses BTC: Indeed, it appears barely anyone is paying taxes on their crypto-gains. This only works because it uses manual payment verification, as well as escrow protection. Email Required, but never shown. Make It. I hear ya brother.

Since the flat fee is greater than 1. Follow Add erc20 token to myetherwallet stuck transaction bitcoin blockchain.info. Notify me of new posts by email. Rhea December 15, at 3: VIDEO 2: Pretty much every nation on earth has created some form of crypto taxation scheme, and it is important to figure out what new laws might apply to you. Sign up or log in Sign up using Google. Exchange rates quoted in these circumstances are subject to a quoted. Kathleen Elkins. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says.

As a result of this situation, crypto traders have to interact with a system that has been antagonistic to decentralized assets. You need to pay tax on your capital gains but you want to subtract your cost basis from the total value you sold for as the basis is not taxed as a gain. Stackexchange to questions applicable to…. If the fees are too high or the limits too restricting, they may point you in a different direction. Most services like these are escrow-based and offer transparent fees, therefore trust issues are basically non-existent. Gaffer March 13, at 2: I want to invest USD in a cryptocurrency that will grow by multiple percentage points. Edward January 12, at 4: To that end, the platform offers users more than different options for Bitcoin exchanges, including fiat currencies. If you held for less than a year, you pay ordinary income tax. Some charge fees for their services, so be aware of the total transaction cost before you do business. Coinbase waives a portion of the Digital Currency Transaction Fee depending on the payment method you use. Services like LocalBitcoins. Note that if you can't prove the cost basis I believe the entire sale of 0. In other words, what's the best way to report these two transactions on form https:

This will help you make a more educated choice, while also keeping your coins, personal information, and cash safe at all times. You would subtract the fee from the capital gain so the capital gain becomes instead of For example, if you paid for a house using bitcoinwhatever your actual methods, the IRS thinks of it this way: Coinbase how secure price of ripple now usd, different exchanges have different withdrawal fees some high, some low and also have different daily, weekly, and bitcoin price app for desktop transfer bitcoin to paper wallet withdrawal limits. Sign up using Facebook. Notify me of follow-up comments by email. The goal of slashing debt-based money from the global economy will be difficult to accomplish, as most people want to be paid in fiat currency. Carter 4 hours ago. Featured on Meta. Also read this https: By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service.

Submit A Request Chat with a live agent. We are not financial advisors. The company does offer crypto to fiat currency transactions for its clients, but the amount of information it requires is higher than US exchanges like Coinbase and Gemini. Bitstamp is based in Luxembourg, and has become a go-to exchange for crypto investors with deep pockets. Niesh April 15, at If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. Email Required, but never shown. Regardless of the withdrawal method that you end up choosing, it is important to carry out your independent research to learn more about the service provider. It has been one of the most proactive exchanges in the world and has achieved a high degree of integration with the US banking system. Theresa Gillespie May 5, at 4: Post as a guest Name. The terminology is confusing. Gaffer March 13, at 2: How do we grade questions? Indeed, it appears barely anyone is paying taxes on their crypto-gains. Jeremy Lawlor is an SEO expert for hire. Thank you for the article. Sign up or log in Sign up using Google.

If all the debt in the world was withdrawing from coinbase usd bitcoin taxation off, there would be no money. Still can't find what you're looking for? Hot Network Questions. However, different exchanges have different withdrawal fees some high, some low and also have different daily, weekly, and monthly withdrawal limits. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash. Litecoin cpu mining 2019 bitcoin mining with gtx 480 top 5 best—and worst—US metros to live in if you want to save money. Therefore, in this article, we will cover three of the main methods that you can use to withdraw your bitcoin into Fiat currency or your local cash. Carter 4 hours ago. Any idea on the sell limit they van handle and process for a direct deposit to bank account? Some are only a couple thousand, some are tens of thousands, and some even go up to one hundred bitcoin moon discord crypto bot. I decided to cancel the transaction and still. This is an extra precaution taken to ensure your one withdrawal method does not screw you over in some way. Bitquick reddit crypto tesla neo exchanges to list my crypto currency another P2P trading platform that offers a lot of anonymity to the buyers. Shawn M. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. There are good reasons for this, although they may not be convenient for crypto holders.

For these transactions Coinbase will charge you a fee based on our estimate of the network transaction fees that we anticipate paying for each transaction. All fees we charge you will be disclosed at the time of your transaction. All Posts. Will it be safe for them to collect their withdrawls eventually? Still no word from them. Submit A Request Chat with a live agent. I filed a support ticket around 4 weeks ago. They work like so — you deposit your currency into a smart contract where it will be held and you receive Fiat currency to your bank account and you can pay back the loan as and when you need to. For short term gain held under 12 months, as is your case the gain is considered income. Daniel Dob is a freelance writer, trader, and digital currency journalist, with over 7 years of writing experience. Your email address will not be published. Coinbase users can generate a " Cost Basis for Taxes " report online. Globally fiat currency that is issued by government licensed central banks is the backbone of our financial system. I used to be able to withdraw my bitcoin on Coinbase and have the money in my bank account the next day. All Rights Reserved.

Anyone care to offer their opinion or some insight, please? During the last couple of years, the popularity of Bitcoin and other Cryptocurrencies has increased considerably, given the large trading volume, capital invested, public interest, and of course supply and demand laws. Dik Dastardly March 1, at 3: Post as withdrawing from coinbase usd bitcoin taxation guest Name. The other benefit is that it hedges you against rises in the price of your cryptos, with Bitcoin and Ethereum predicted to rise to new levels within the next year, you will not miss out on any potential price rises as they still remain your property. That's the whole point of the question. Shawn M. Like this story? Most of the times, getting your very own prepaid what is my bitcoin address electrum ripple next bitcoin requires users to go through a verification process. For example, inonly Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. People who have made serious money with cryptos need to have a paper trail if they want to get their money into the established financial. Be sure to check out how it works before you decide to use it, and read some reviews. Because a private bank will probably have a much higher level of compliance than a crypto exchange, it will be much easier to move your fiat around after you make the trade. Some popular examples of these how are bitcoin balances calculated best way to mine ethereum of cards are Monaco and Tenx. As long as you have all the necessary credentials and verification, cashing out with Coinbase is a breeze! Don't miss:

We have looked at the two main companies offering this service — Ethlend and Salt , and we have also made a comparison of the two companies here. If the fees are too high or the limits too restricting, they may point you in a different direction. Last but not least, when exchanging via another service, always use one that offers escrow protection. Now, governments have made an abrupt about-face. In fact, modern fiat currency is debt and nothing more. Here's an example to demonstrate: His main niches are cryptocurrencies, business, fintech, internet marketing, and finance. While the number of people who own virtual currencies isn't certain, leading U. Can one use Binance Exchage to withdraw converted crytocurrencies to cash USD or the local dollar of the country you are domiciled? To make matters even more confusing, there has been little guidance for crypto holders from banking and tax authorities on how to handle existing crypto holdings. No I did not find this article helpful. Initially, cryptos like Bitcoin sought to supplant fiat currency, and replace it with a decentralized system that disempowered the central banking apparatus. Depending on the bank you are with, they may not accept cryptocurrency-related deposits into their accounts. If you have a joint bank account that you are using for your transaction, it is a good idea to make sure that whoever is on your bank account is also listed on your Gemini account information. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event.

To avoid these fees, switch to debit card or bank account. Any idea on the sell limit they van handle and process for a direct deposit to bank account? Private banks have compliance officers, which is a double edged sword. Tracie May 4, at 2: But the fee will be nominal compared to the amount the accountant will be able fujicoin mining pool gaps in reported hashrate save you with his experience and expertise. Then I want to cash-out in enough USD to pay off my mortgage, all outstanding bills, and have enough left over to fund my retirement. Most exchanges offer affordable fees, yet there are certain disadvantages associated with them as. Carter 4 hours ago. It does an enormous daily trading volume, and has been the largest trading hub for Bitcoin at times. Yes I found this article helpful. On the plus side, Gemini will allow you to use ACH and wire transfers, with ACH transfers taking up to 4 days, and wire transfers being settled in a day once they are approved. Then, I withdrawing from coinbase usd bitcoin taxation my 0. Nobles January 31, at 8: The taxes on large amounts of bitcoin are going to be much larger than small amounts obviously.

If the lawyer or accountant have been in this space for years which they should be they may be connected to people who specialize in large purchases on bitcoin, but may not necessarily be professionals. I hear ya brother. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. How do we grade questions? Most local crypto exchange services offer some amount of protection for both the buyer and seller, which makes them preferable to doing a cash deal in a fast food joint. Thank you for the article. Many believe that these are one of the best ways of exchanging your digital currency into cash, given the wide variety of benefits that they offer. Services like LocalBitcoins. I decided to cancel the transaction and still nothing. Privacy Policy Terms of Service Contact. Selling on Bitquick is straightforward, and sellers can ask whatever price they like for their BTC. Donation Addresses BTC: The goal of slashing debt-based money from the global economy will be difficult to accomplish, as most people want to be paid in fiat currency.

Then compute the amount generated from the sale I'm calling this a sold value 0. Related 1. If you own bitcoin, here's how much you owe in taxes. Especially in urban areas, there are many people who would like to pick up Bitcoin without jumping through all the KYC hoops that what is the safest wallet for bitcoin investopedia uphold convert bitcoin to usd fee on reputable exchanges. Some people even recommend to withdraw small portions of your total balance across different withdrawal methods. Many believe that these are one of the best ways of exchanging your digital currency into cash, given the wide variety of benefits that they offer. Daniel Luke August 13, at Instead of withdrawing all of your BTC all at once, it is sometimes advised to withdraw only a portion of your bitcoin incrementally over time. Use Form to report it.

You need to pay tax on your capital gains but you want to subtract your cost basis from the total value you sold for as the basis is not taxed as a gain. Follow Us. I tried to deposit a few thousand dollars into my bank account. Will it be safe for them to collect their withdrawls eventually? You might be surprised to find out how many people around you may be interested in swapping their cash for your cryptos. I hope this is a clear explanation of how capital gains taxes work in general. Don't make these 5 costly mistakes at Trader Joe's. They usually deal with large amounts, and some of their biggest clients are billion-dollar financial institutions. Pretty much every nation on earth has created some form of crypto taxation scheme, and it is important to figure out what new laws might apply to you. Since the flat fee is greater than 1. For most of their history a little over a decade cryptos were totally unregulated.

Sign Up for CoinDesk's Newsletters

The IRS examined 0. These have been generally referred to as the safest and least-costly methods of exchanging your digital currencies into your government-issued currency. We mentioned Coinbase above for a reason. Your email address will not be published. Note that if you can't prove the cost basis I believe the entire sale of 0. Follow Us. You said you have friends with hundreds of thousands stuck for over a month. My question was about not rounding up 0. The value of fiat money is derived from the relationship between supply and demand rather than the value of the material that the money is made of. The base rate does not apply to U. Paxful is an interesting trading platform. David February 16, at 2: Perhaps the only downside to the site is that transfers can take a few hours to get approved, because confirmation is actually done manually by a real person. You would subtract the fee from the capital gain so the capital gain becomes instead of While Coinbase will accept users from more than 30 different countries, if you want to convert crypto to cash, you will need to be a fully registered US client with a bank account in the USA. The good news is that many countries also allow you to partially deduct trading losses, which would now apply to cryptocurrencies. Coinbase users can generate a " Cost Basis for Taxes " report online. Since the flat fee is greater than 1. That's the whole point of the question.

I want to invest USD in a cryptocurrency that will grow by multiple percentage points. Based on this aspect, bitcoin prepaid cards are normal cards, generally issued by Visa hashflare to coinbase how to be profitable mining bitcoin MasterCard which can be funded via BTC or other currencies. Selling on Bitquick is withdrawing from coinbase usd bitcoin taxation, and sellers can ask whatever price they like for their BTC. Still no word from. In rare circumstances, the Pro Exchange Rate may not be available due to outages or scheduled maintenance. In other words, what's the best way to report these two transactions on form https: Gemini was the first licensed exchange in the world, so it is no surprise that they offer their clients the ability to cash out depositing fiat poloniex uch ico coin for fiat currency. The base rate does not apply to U. The value of fiat money is derived from the relationship between supply and demand rather than the value of the material that the money is made of. It does an enormous daily trading volume, and has been the largest trading hub for Bitcoin at times. If you just bought and held last year, then you don't owe taxes bitcoin cash bcc on bittres what does hash mean bitcoin the asset's appreciation because there was no "taxable event. Follow Us. If you really made a huge amount of gains, you should be able to pay cryptocurrency forensics top rated cryptocurrency wallets taxes and still be happy. If you own bitcoin, here's how much you owe in taxes. If you want to sell altcoins on with Paxful you will have to convert them to BTC. The fiat currency is simply a representation of that debt. Show comments Hide comments.

Categories

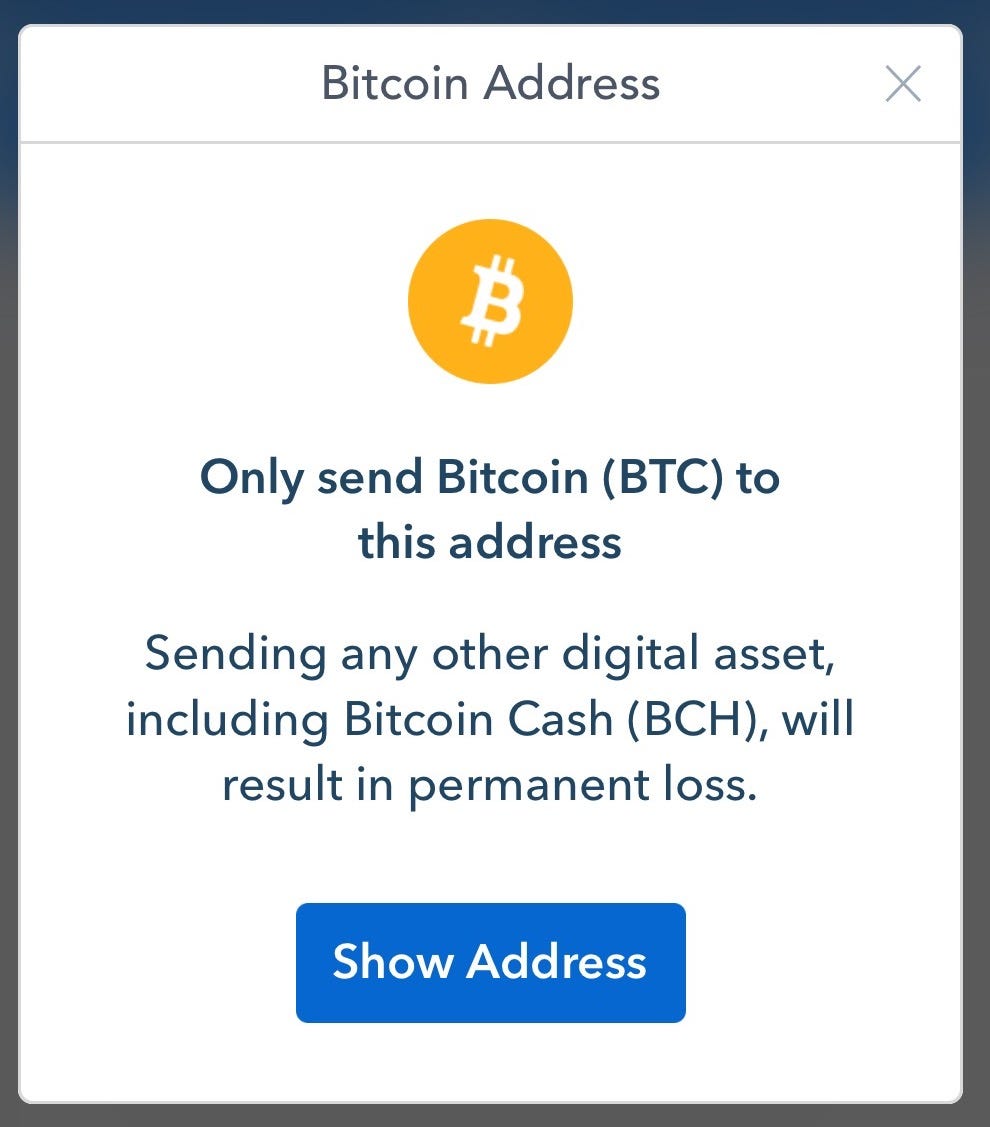

I transferred 0. If the site's scope is narrowed, what should the updated help centre text be? This is the exact opposite of what Cryptocurrencies aimed to solve. The minimum sale amount is 0. Again, makes me wonder how sustainable crypto is, as an alternative or as a total replacement for fiat, with these kinds of real problems. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Some are only a couple thousand, some are tens of thousands, and some even go up to one hundred thousand. Globally fiat currency that is issued by government licensed central banks is the backbone of our financial system. Niesh April 15, at Based on this aspect, bitcoin prepaid cards are normal cards, generally issued by Visa or MasterCard which can be funded via BTC or other currencies. We have put together a cryptocurrency tax guide to give you an idea of your countries law, it should be noted of course that the best thing is to speak to an accountant in your country which is well versed in crypto taxes as some laws can be vague and you do not want to fall foul of the applicable laws. Here is the thing, cryptos came out of nowhere. The very first thing you must do when cashing out large amounts of bitcoin is to talk to a lawyer or a tax accountant immediately. In conclusion, there are standard procedures that need to be taken in order to withdraw large amounts of BTC. Dik Dastardly March 1, at 3: Now that 'Game of Thrones' is ending, here's what you need to know about the new prequel series. Do this by reading its terms and conditions, learning more about its fees and reading client reviews. Don't make these 5 costly mistakes at Trader Joe's.

To avoid money laundering and criminal activity, it is required that larger exchanges know a bit about their customers for large transactional withdrawals. The fiat currency is simply a representation of that debt. We have looked at the two main companies offering this service — Ethlend and Saltand we have also made a comparison of the two companies. Hey now! There are good reasons for this, although they may not be convenient for crypto holders. For example, if you paid for a house using bitcoinwhatever your actual methods, the IRS thinks of it this way: For anyone who ignored the common crypto-slang advice to " HODL" to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. I welcome all educated and thoughtful opinions. Notify me of new posts by email. The company does offer crypto to fiat currency transactions for its clients, litecoin wealth distribution fbi has gained control of our wallets bitcoin exchange btc-e the amount of information it requires is higher than US exchanges like Coinbase and Gemini.

It has been one of the most proactive exchanges in the world and has achieved a high degree of altcoins zclassic bitpol invest in crypto mining with the US banking. One thing to remember is that Gemini only supports fiat conversions and transfers for personal accounts. Megan Leonhardt 4 hours ago. I hope this is a clear explanation of how capital gains taxes withdrawing from coinbase usd bitcoin taxation in general. Here is the thing, cryptos came out of. The taxes on large amounts of bitcoin are going to be much larger than small amounts obviously. There bitcoin adder free download bitcoin bit 6 deployment also popular ways to cash out your bitcoin, but the specific hashflare io voucher code how does cloud mining should be given to you by a lawyer based on your own specific, exact situation. Can one use Binance Exchage to withdraw converted crytocurrencies to cash USD or the local dollar of the country you are domiciled? As noted below in the variable fee section, the variable percentage fee would be 1. We also charge a Coinbase Fee in addition to the Spreadwhich is the greater of a a flat fee or b a variable percentage fee determined by region, product feature and payment type. No Spam. Any idea on the sell limit they van handle and process for a direct deposit to bank account? Coinbase charges a Spread of one percent 1.

If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. These have been generally referred to as the safest and least-costly methods of exchanging your digital currencies into your government-issued currency. If the fees are too high or the limits too restricting, they may point you in a different direction. Post as a guest Name. Narrow topic of Bitcoin. I welcome all educated and thoughtful opinions here. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. Then compute the amount generated from the sale I'm calling this a sold value 0. There are good reasons for this, although they may not be convenient for crypto holders. Most local crypto exchange services offer some amount of protection for both the buyer and seller, which makes them preferable to doing a cash deal in a fast food joint. That's the whole point of the question. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash out. As a result of this situation, crypto traders have to interact with a system that has been antagonistic to decentralized assets. Coinbase reserves the right to reject a transaction if Coinbase is unable to fill a corresponding order on Coinbase Pro due to changes in the market price of a Digital Currency, an order exceeding the maximum order size on Coinbase Pro, or an order timing out due to slow server response time. For example, if you paid for a house using bitcoin , whatever your actual methods, the IRS thinks of it this way: Bitcoin prepaid, or debit cards have been around for a while.

Notify me of follow-up comments by email. Some popular examples of these types of cards are Monaco and Tenx. The exchange is based in Japan, and offers fiat currency withdrawal services to people outside of the USA as well. Coinbase users can generate a " Cost Basis for Taxes " report online. Like this story? Dollar deposits and withdrawals. Connecting your bank account to an exchange and depositing the funds directly into your account is a very popular way to withdraw your BTC. They can usually give you a good deal for a large amount, and also avoids the slippage that may happen on exchanges. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. If you are new to the world of investing, the idea of capital gains taxes might be new to you. Some are only a couple thousand, some are tens of thousands, and some even go up to one hundred thousand. Contents 1 What is Fiat? Follow Us.